The 2020 Automotive Software Survey Report, written by Ian Riches from Strategy Analytics and Roger Ordman from Aurora Labs, is now online!

Our 2020 Automotive Software Survey shows more evidence of the transformation happening in the automotive industry. Unique to this report, however, is the focus on two main vectors of transformation: more centralised vehicle architectures and more software developed in-house by the automotive OEM.

There are significant concerns as to how quickly the industry is moving and whether car manufacturers own the required skills. The function of OTA updates is crucial. Cost control and complexity will be essential to ensure that customers stay satisfied with their vehicles throughout their lifecycle.

The key conclusions of the 2020 Automotive Software Survey are as follows:

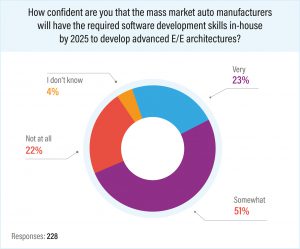

- There was wide agreement that OEMs will develop more software in-house, but only a lukewarm affirmation that they possessed the required skills to do so.

- This widely agreed trend is at odds with the current status quo, with the most popular answer to how many software suppliers there are to a current vehicle being ‚Over 50‘.

- Domain-based architectures are coming – but most saw volume deployment in MY2027 or later.

It is clear that the importance of software is growing for the automotive industry and evolving from an enabler for the hardware, to become key differentiating features. The vehicle manufacturers are being challenged to meet the resource requirements for software to become a strategic component of the vehicle and the automotive industry.

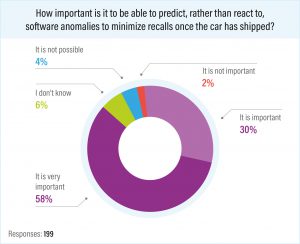

- Multiple aspects of ensuring software quality are seen as difficult and/or getting more difficult, with a strong expressed preference for the ability to have insight into the behavior of the software functions during the development process as well as to be able to predict software anomalies.

- There was overwhelming agreement that OTA updates bring far more than just the ability to roll-out bug fixes. This opinion was strengthened by the fact that 83% of respondents envisaged at least two OTA updates per vehicle per year, with one-in-six (17%) predicted more than 24 updates a year – and so we’re clearly looking to see more than bug fixes implemented.

- It is clear that the OTA business will be on a very steep growth curve in the coming years. Market needs (a vehicle which continues to improve post-factory), OEM requirements (controlling the spiraling cost of physical recalls) and legislation frameworks are all now aligning.

The industry is acknowledging that software quality is no longer a single stage of the vehicle development process. Software quality is expected to be maintained throughout the vehicle’s lifecycle and the vehicle manufacturers are expected to take a more proactive approach towards maintaining vehicle software quality.

To read the full 2020 Automotive Software Survey report with over 20 engaging graphs, please click here

5 min read

5 min read